Earning Flybuys and redemption rates can change without notice. BNZ (and its related companies) do not guarantee the redemption of Flybuys or that Flybuys will continue to be offered for products or services provided by BNZ. Actual amounts may vary slightly due to rounding.įlybuys can only be earned on Flybuys loans. Flybuys terms and conditions apply.Type 'Balance' in cell A1, 'Interest rate' in cell A2 and 'Periods' in cell A3. Your repayment amounts are calculated on a “principal and interest” basis for the term of the loan. Create labels in cells A1 down to A4 for the variables and result of your monthly payment calculation.

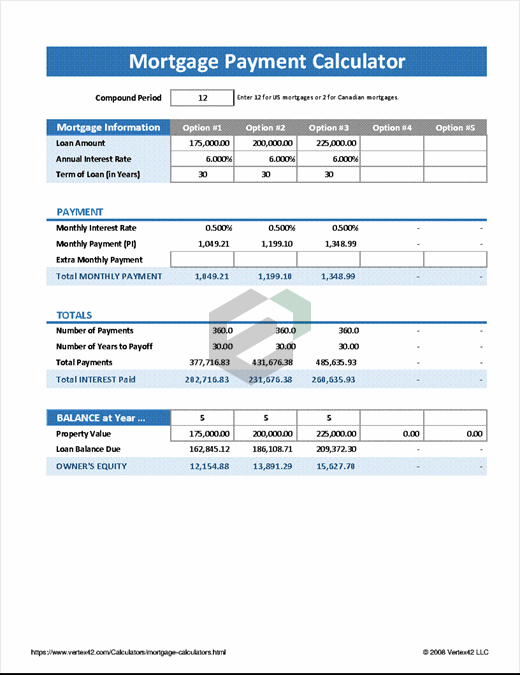

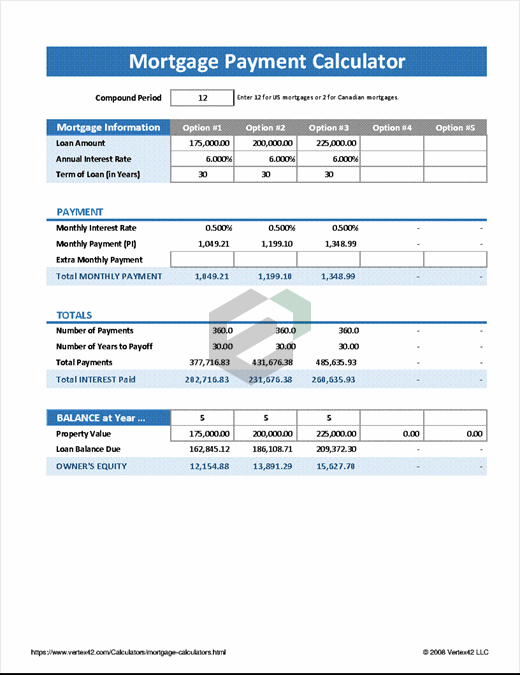

The interest on your home loan is calculated daily and charged at the same frequency as you choose for repayments, over the term of your loan.Note that in reality, interest rates are likely to change over time. The calculator shows the expenses, payments. The interest rate remains the same for the term of your home loan. With the mortgage calculator, you will be able to quickly calculate your monthly mortgage payment and expenses.

#Calculate house payment full#

You make all your repayments in full and on time. You can find this information on your pay check or you can ask your HR. You don’t make any additional lump sum repayments or increase your regular repayments above the standard repayments (but you could choose to do this to reduce the term and interest charges, if your loan allows). Use our bank independent mortgage calculator and let us calculate your maximum. There are no changes to the loan amount and you don’t borrow any extra on this loan. We’ve had to make some assumptions to calculate your approximate repayments: Annual interest rate / 12 monthly interest rate. If you want the payment estimate to include taxes and insurance. Step 1: Convert the annual interest rate to a monthly rate by dividing it by 12. Start by providing the home price, down payment amount, loan term, interest rate and location. If you entered into a home loan before 23 October 2018 and haven’t been advised that your loan is moving to one of the above interest rate types, see applicable rates here. Our amortization calculator will do the math for you, using the following amortization formula to calculate the monthly interest payment, principal payment and outstanding loan balance. An establishment fee of up to $150 may apply.Ī Residential Owner Occupied rate or Residential Investor rate will apply. Some interest rates may require you to have a certain minimum equity in the property used as security, and for some rates a low equity interest rate premium rate may apply if you have a low loan to value ratio. Your monthly payment Total interest paid Total amount you pay in payments Tip. Monthly Payment the payment amount to be paid on this mortgage on a monthly basis toward principal & interest, taxes and insurance.Things you should know about our home loans and this calculatorĪll home loans are subject to our lending criteria (including minimum equity requirements), terms and fees. Use this calculator to estimate the monthly repayments for your dream home. Insurance If your financial institution will be keeping an escrow account, billing you, and handling the payment of your property insurance then include that yearly amount here. Taxes If your financial institution will be keeping an escrow account, billing you, and handling the payment of your property taxes then include that yearly amount here. Note that this is the interest rate you are being charged which is different and normally lower than the Annual Percentage Rate (APR).

Mortgage Amount the original principal amount of your mortgage when calculating a new mortgage or the current principal owed when calculating a current mortgage Mortgage Term the original term of your mortgage or the time left when calculating a current mortgage Interest Rate the annual nominal interest rate or stated rate on the loan. For a 250,000 home, a down payment of 3 is 7,500 and a down payment of 20 is 50,000. A 20 down payment is ideal to lower your monthly payment, avoid private mortgage insurance and increase your affordability.

Most home loans require a down payment of at least 3. Mortgage calculator without taxes and insurance. The amount of money you spend upfront to purchase a home. Also offers loan performance graphs, biweekly savings comparisons and easy to print amortization schedules. This is a good estimate when keeping taxes and insurance in an escrow account the payment charged by your financial institution could be different.įor a simple calculation without insurance and taxes, use this Estimate your monthly payments with PMI, taxes, homeowners insurance, HOA fees, current loan rates & more. When calculating a new mortgage where you know approximately your annual taxes and insurance, this calculator will show you the monthly breakdown and total. Calculate your total monthly mortgage payment.

0 kommentar(er)

0 kommentar(er)